Financial Planning

Financial planning is an evolutionary process and not a leather-bound book to put on your shelf at homeFINANCIAL PLANNING

Relationship with Trusted, Knowledgeable Financial Experts

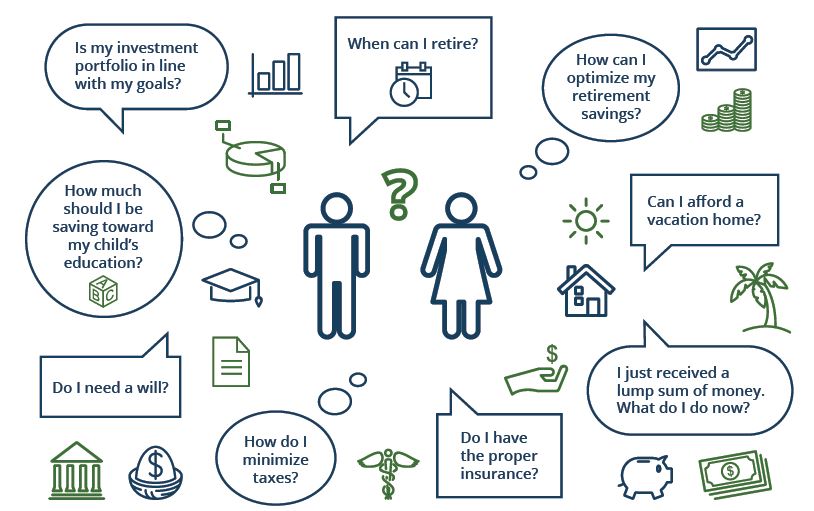

Financial planning is an evolutionary process and not a leather-bound book to put on your shelf at home. It is not a “thing” that you purchase, but a long-term relationship with a trusted and knowledgeable financial expert, who is committed to putting you first. At Frisch Financial Group, our financial planning and wealth management services START with peoples’ lives – not numbers.

Chances are that you have some specific issues or concerns that have brought you to us. With our process, you don’t have to wait months to complete a formal, written financial plan before any action is taken – by then it could be too late. We have the 25+ years of expertise to evaluate your goals, needs, tax situation and risk profile to help you take immediate action on those pressing items, while identifying additional issues and creating an agenda to perform further in-depth analysis.

Our financial planning process is unique in regards to the time commitment we require because we understand that your time is valuable. Our financial planning process does not require hours of your time meeting on a weekly or bi-weekly basis. We find that many people are extremely overwhelmed by the traditional financial planning process due to the information overload that comes at the end of it. This can lead to the abandonment of financial planning with little to no action taken.

Our financial planning process values your time and provides the financial planning process in quarterly pieces. We will help you prioritize your most pressing needs and address each accordingly. At each quarterly meeting, we address a specific category of the financial plan going over our calculations, projections, likely implications and recommendations. We explain everything and thoroughly educate you on the options so that you can make informed decisions and take action.

We don’t provide advice or guidance without being able to see the entire picture, and we don’t take any action until you completely understand what we’re doing, why we’re doing it and any costs associated with the recommendation. Frisch Financial Group is a Registered Investment Adviser and we take our fiduciary responsibility very seriously and only make recommendations that are best for you and free from conflict.

Frisch’s Financial Planning Services are 100% customized to your situation, goals, needs, time frame, and risk tolerance.

Because life is never a straight line and changes in goals and circumstances are as inevitable as death and taxes, we regularly re-evaluate where you’re at and adjust the plan accordingly. We treat life as a journey and help you make decisions that bring you and your family happiness and financial security at every point along the way.

We provide a wide array of customized financial planning services. These comprehensive financial services include, but are not limited to:

Specialty Planning

Small Business Planning

Planning for Significant Expenses (i.e., college tuition, home, etc.)

Financial Planning in the Event of Divorce

Financial Windfall Planning (i.e. inheritance, lottery)

Widow/Widower Assistance

Executive Compensation Strategies & Stock Option Planning

Single Stock Concentration Analysis

ISO v. Non-Qualified Options & Exit Strategies for Grants

Review Deferred Compensation Strategies

AMT Considerations

Pension, Profit Sharing & Employee Benefit Plan Consultation

Analyze Retirement Plans

Identify Potential Pre-tax Benefits

Maximize Tax Deferral Methods

Retirement Plan Investment Management

Retirement Planning

Inflation Rate v. Investment Return Analysis

Life Expectancy & Minimum Distribution Calculations

Early Retirement Analysis

Estate & Gift Tax Planning

Review of Existing Estate Planning Documents

Gifting Techniques & Use of Trusts

Estate & Generation Skipping Transfer Tax Illustrations

Charitable Planned Giving Techniques

Investment Planning

Asset Allocation Models

Performance Evaluations

Income v. Growth Analysis

Income Tax Planning

Minimization of Tax Liability

Tax Planning with Investments

Wealth Preservation Strategies

Personal Insurance Planning & Risk Analysis

Existing Coverage v. Necessary Coverage Review

Review of Life, Disability, Long-Term Care, & Property and Casualty Policies

Cash Flow Management & Personal Budget Preparation

Multiple-year Projections

Annual Expense to Income Reports

Identifying Cash Flow Improvements

If you’re interested in learning more about our financial planning process and determining if it’s fit for you, we would be happy to meet you in any of our offices (Long Island, New York City, Westchester, or Tampa).

SEND US A MESSAGE

Financial Education Matters

When you sign up to receive our Newsletter, we keep you informed with financial updates, educational articles, and breaking news.

Our Locations

Reach Us

445 Broad Hollow Road

Suite 215

Melville, NY 11747

P: 516-694-7900

F: 516-694-7901

1140 Avenue of the Americas 9th Floor

New York, NY 10036

P: 212-983-8444

F: 212-983-8151

2202 N. West Shore Blvd

Suite 200

Tampa, FL 33607

P: 813-639-7580

F: 813-639-7501

777 Westchester Ave

Suite 101

White Plains, NY 10604

P: 914-696-0800

F: 914-696-0808